Fact Sheet 1 – Financial Assistance Grants

- The 2022-23 Budget maintains the system of payments to support local government, through Financial Assistance Grants.

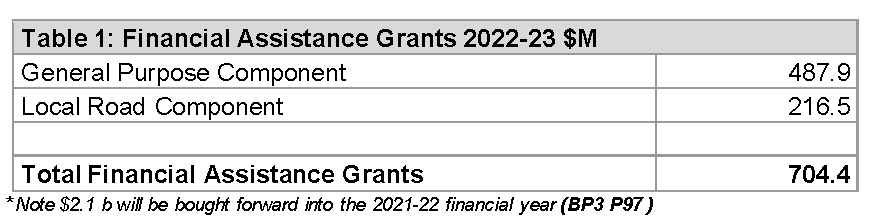

- In 2022-23 the Australian Government will provide $2.8b in Financial Assistance Grants funding. This includes $2.1b which will be brought forward from the 2022-23 estimate and paid to State and Territory Governments in 2021-22

- The Financial Assistance Grants as a proportion of Commonwealth Tax Revenue in 2022-23 is therefore estimated to be 0.55%%. In 2021-22 – this was 0.6%

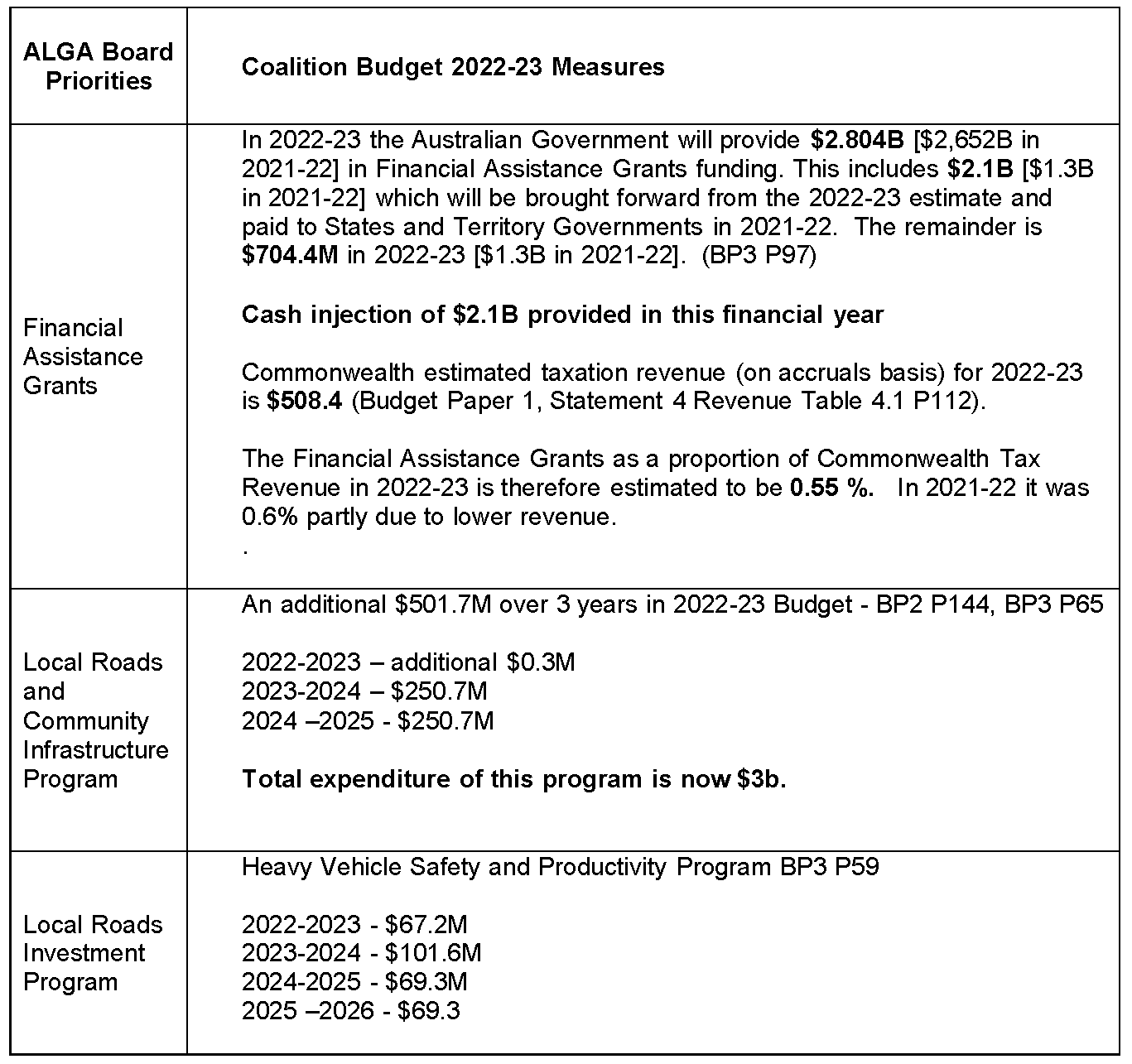

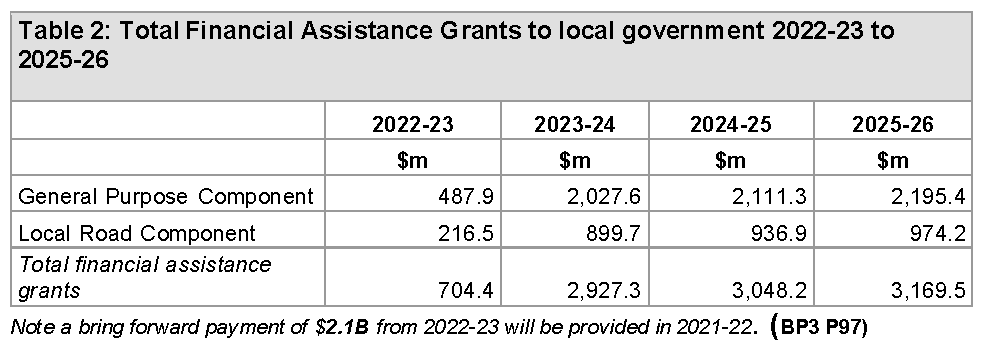

- Financial Assistance Grants continue to comprise two components: general-purpose assistance grants; and untied local roads grants.

*Note $2.1 b will be bought forward into the 2021-22 financial year (BP3 P97 )

Note a bring forward payment of $2.1B from 2022-23 will be provided in 2021-22. (BP3 P97)Note a bring forward payment of $2.1B from 2022-23 will be provided in 2021-22. (BP3 P97)

Fact Sheet 2 – Transport – A local government perspective

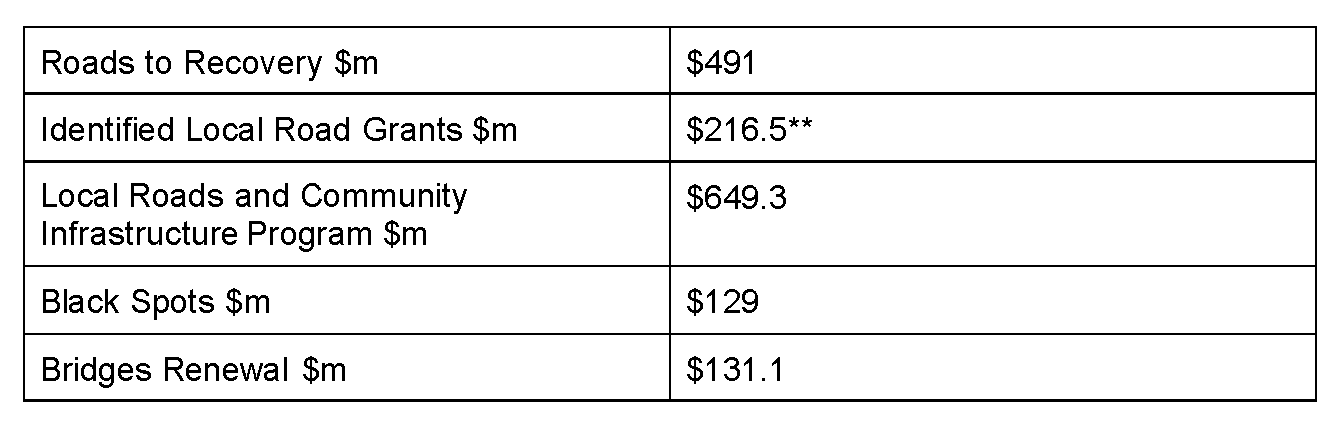

Commonwealth funding for Local Roads in 2022-23:

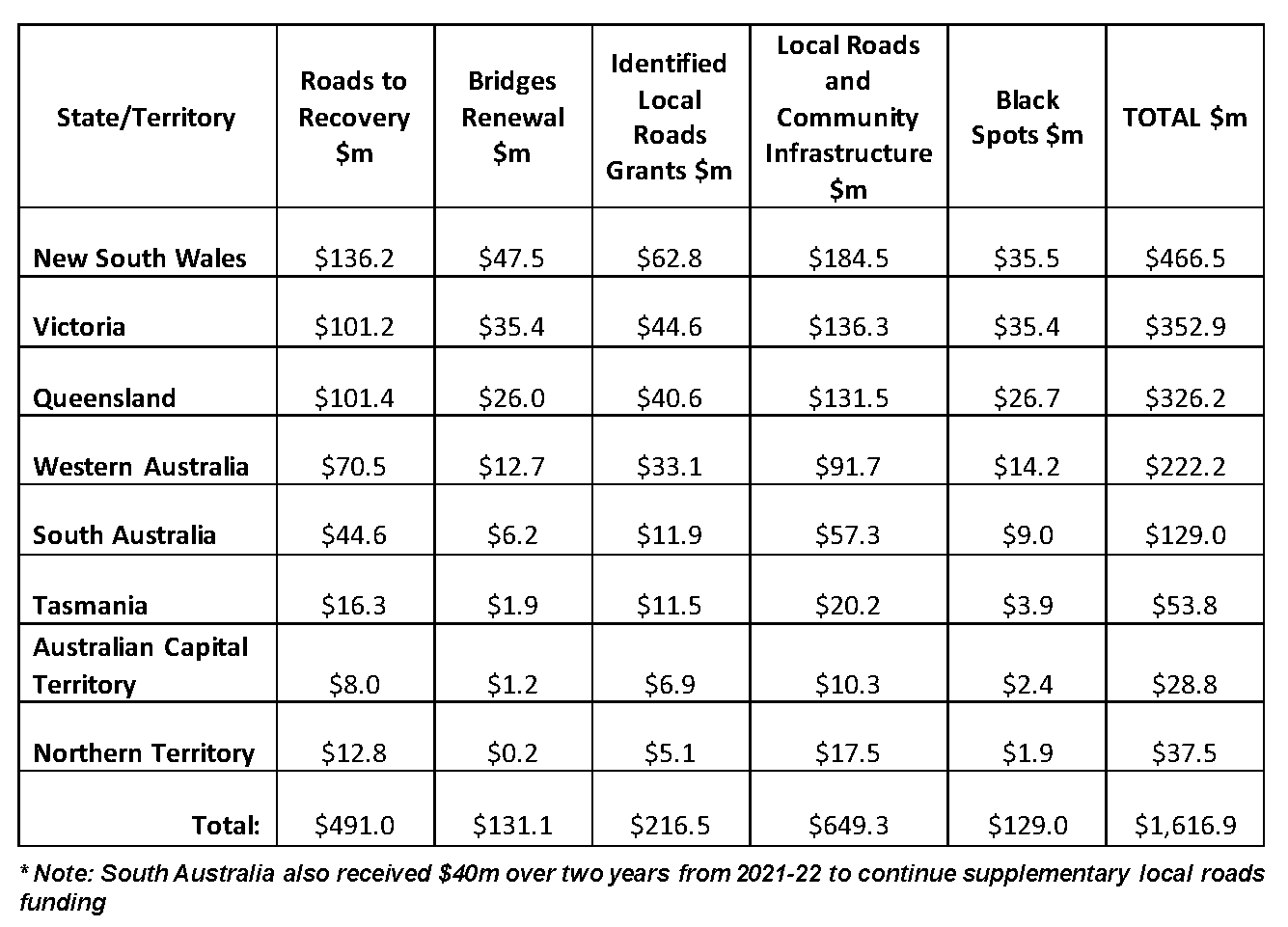

Total road funding allocation for local governments, by State/Territory in 2022-23 is set out in the table below:

Sum of the components above may not add to the total due to rounding,* Note: South Australia also received $40m over two years from 2021-22 to continue supplementary local roads funding

**also note that $2.1B of Financial Assistance Grant funding has been bought forward to 2021-22.

Fact Sheet 3: 2022-23 Budget Overview

1. General overview and economic outlook:

- Deficit of 1.6% of GDP by 2025-26

- Working towards 4% unemployment

- Wages growth 3%

- 3.5% econ growth in 2022-23

2. Budget Priorities:

- Living relief for Australians

- Supporting small business

- Investing in roads, & infrastructure

- Flood relief and response

3. Key initiatives and savings measures:

- Temporary cut to fuel excise

- Continued funding of the Local Roads and Community Infrastructure Fund

- Bring forward FA Grants of $2.1B into 2021-22

- $37.9B regions & infrastructure

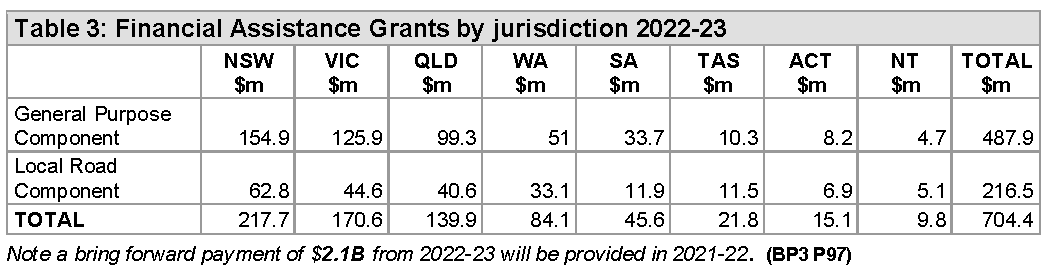

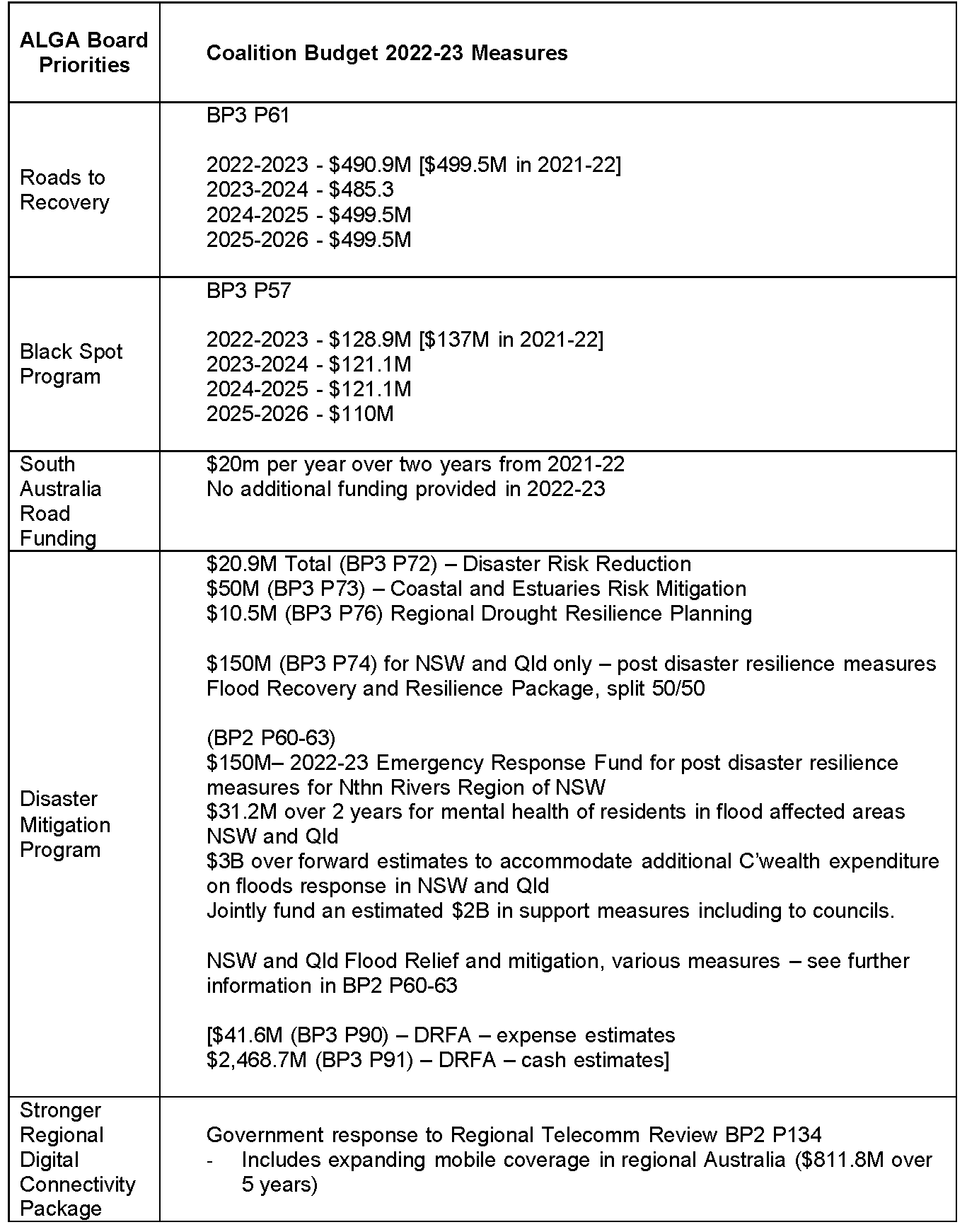

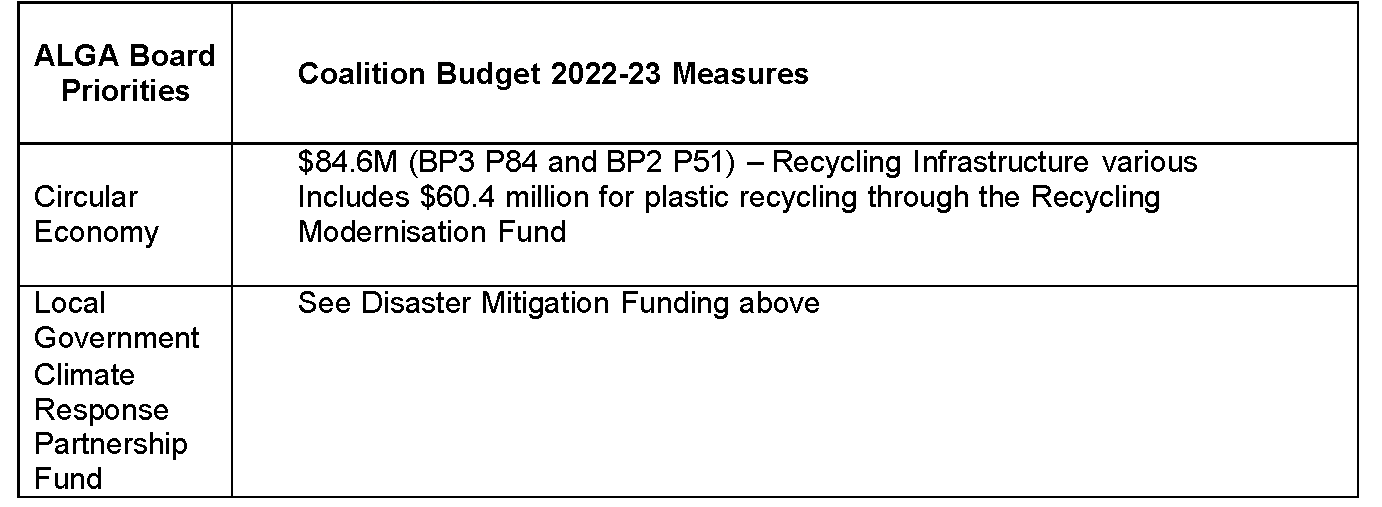

4. ALGA Board Priorities and Federal Budget initiatives

5. Other measures of interest for local governments in the Coalition Federal Budget:

- Temporary reduction in fuel excise BP2 P15

- Future Drought Fund – $84.5M over 4 years BP2 P53

- Great Barrier Reef leadership and stewardship- $1B over 9 years BP2 P56

- Women’s Safety – BP2 P66

- Boosting Participation and Building Australia’s workforce $153.5M over 5 years BP2 P74

- Investing in Skills apprenticeships BP2 P76

- Supporting rural health $224.4M over 4 years BP2 P98

- Preventative Health – $30.1M includes community health/physical activity BP2 P107

- Safer Communities Fund Round 6 – an additional $50M over 2 years from 2022-23 – available for local governments to apply BP2 P119

- Community Development Grants – nominated projects $67.7M over 3 years BP 2 P130

- COVID 19 – additional arts sector support BP2 P131

- COVID 19 – additional aviation support BP2 P132

- Infrastructure Investment – priority regional infrastructure – $1.5B over 10 years – various projects

- Regional Accelerator Program – $2B over 5 years – drive economic growth in regional areas

- Stronger Communities Program $29.2 M over 2 years – small projects. BP2 P152

- Supporting regionalisation – new childcare centres, employment opportunities $67.7M over 8 years BP2 P152

- Digital Economy Strategy – includes Office of Future Transport Technology BP2 P157

- Disaster Support – NFP – various BP2 P158

- $31.8M in 2022-23 to commence establishment of 35 regional/local voice bodies across Australia (BP2 P161) –

- Affordable Housing and Home Ownership – increase to 50 000 places/year BP2 P170

- Funding for remote indigenous housing – NT only $223.8M in 2022-23 (BP3 P54)

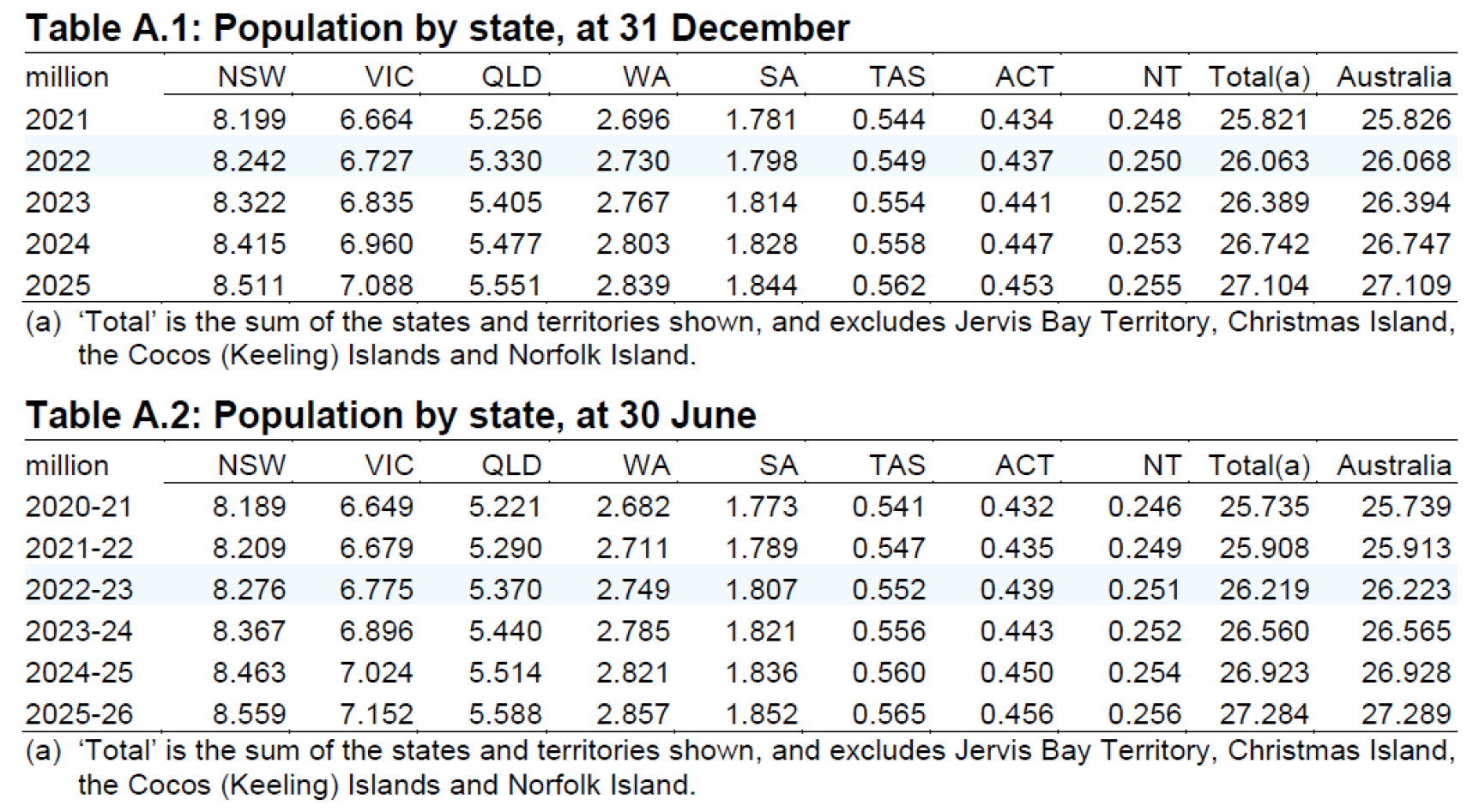

Population Assumptions used in the Budget (BP3 P113)

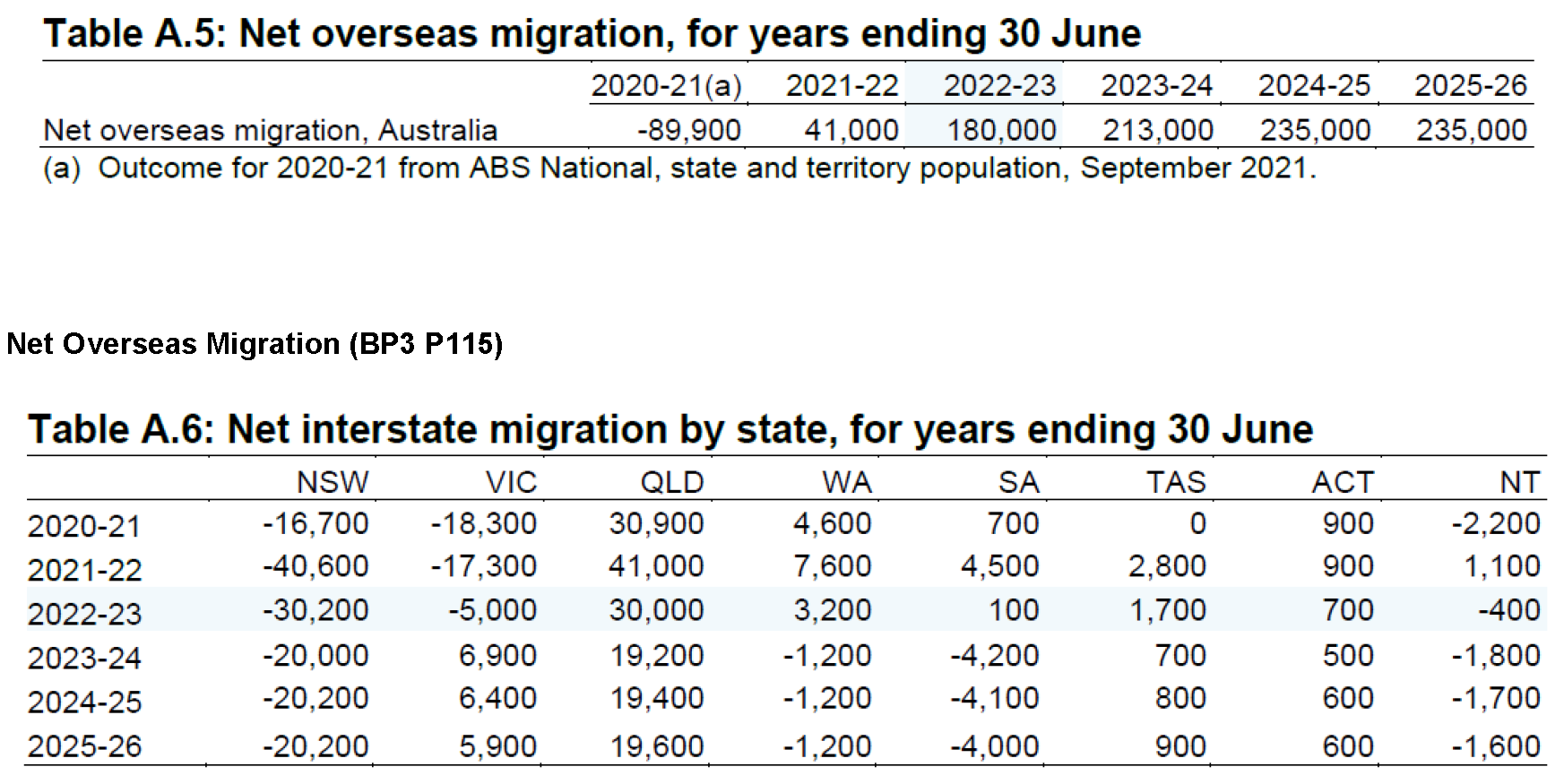

Net interstate migration (BP3 P115)

Net Overseas Migration (BP3 P115)